Where is the market headed? Is now the time to refinance? What term length offers the most savings for set goals? All great questions that homeowners have been asking, what with the incredible dip in interest rates.

The great news is you don't have to be a mortgage expert to save hundreds, even thousands, over the life of your loan. You simply have to pay attention to market trends and make educated guesses as to where it's headed.

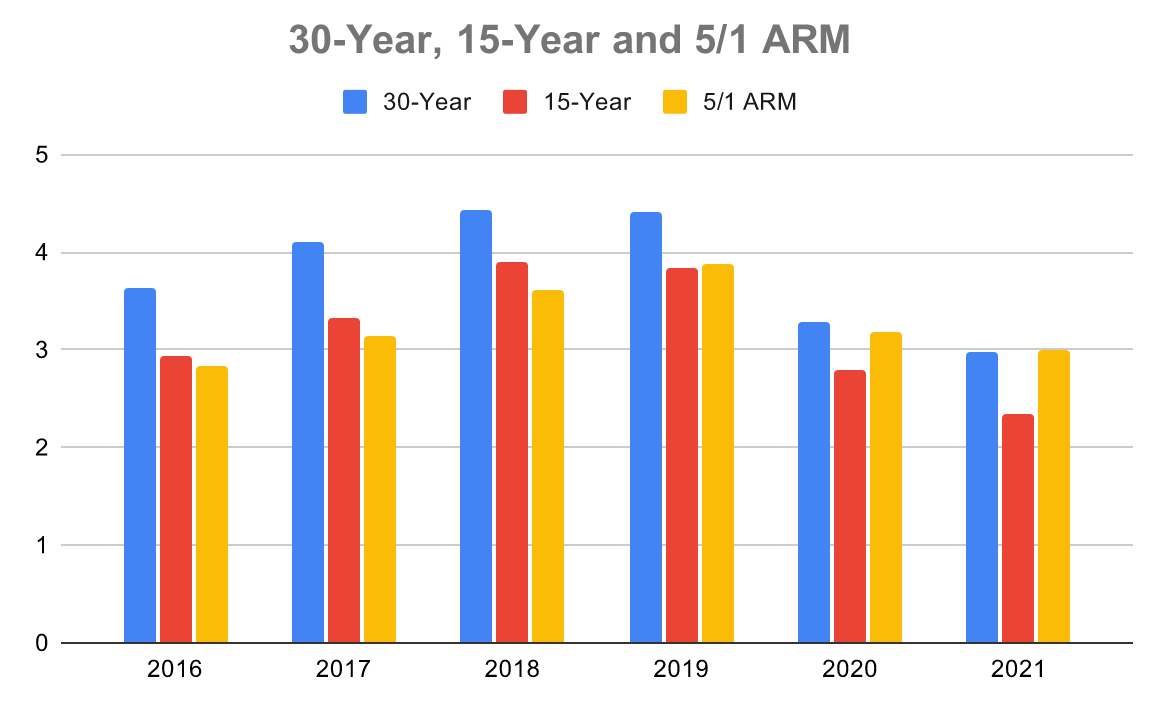

With data from Freddie Mac, we've put together mortgage information over the last six years so you can start to evaluate the market and determine the optimal time to refinance.

Get Free QuotesMarch 2016

Here's what the stats looked like for the week ending March 3.

- 30-year fixed-rate mortgage: 3.64%

- 15-year fixed-rate mortgage: 2.94%

- 5/1 adjustable-rate mortgage: 2.84%

Not sure what the 5/1 is all about? We've got more information on adjustable-rate mortgages here.

Here's how the market looked just one month later, for the week ending March 31.

- 30-year: 3.71%

- 15-year: 2.98%

- 5/1 ARM: 2.90%

Interest rates went up across the board in just a few weeks' time. That means that if you were thinking about refinancing at the beginning of March 2016, and took some time to think it over, you already missed out on potential savings.

March 2017

Unfortunately for borrowers looking for a mortgage or to refi in 2017, the market didn't get any better. In fact, rates saw a sharp increase.

- 30-year: 4.10%

- 15-year: 3.32%

- 5/1 ARM: 3.14%

How did the market trend as the month went on? Here's how March of 2017 concluded.

- 30-year: 4.14%

- 15-year: 3.39%

- 5/1 ARM: 3.18%

March 2018

The passage of just one year brought bad news for homeowners or those looking to secure their first mortgage.

- 30-year: 4.43%

- 15-year: 3.90%

- 5/1 ARM: 3.62%

And the trend continued as it had the two years prior; the end of the month brought an even bigger increase in rates.

March 2019

This is the year things started to take a turn. Here's how the week ending on March 7 looked.

- 30-year: 4.41%

- 15-year: 3.83%

- 5/1 ARM: 3.87%

While still considered quite high, the interest rates for both a 30-year and a 15-year fixed-rate mortgage fell.

March 2020

Cut to March of 2020, when the global COVID-19 pandemic started to shut down the U.S. economy.

- 30-year: 3.29%

- 15-year: 2.79%

- 5/1 ARM: 3.18%

30- and 15-year fixed mortgage interest rates weren't even that low back in 2016! You can also start to see that 5/1 ARMs tend to hover in the roughly the same range as the years go on.

February 2021

Here's how February of 2021 closed out.

- 30-year: 2.97%

- 15-year: 2.34%

- 5/1 ARM: 2.99%

That's a significant drop across all three options from 2020 to 2021, and rates have held at lows into the beginning of March.

Interpreting the Data

Here's what the data looks like side-by-side.

As you can see, mortgage interest rates are closely tied to what's happening in the economy. That's probably not brand-new information for you, but it is still useful information. As families struggle to make ends meet, mortgage contracts have been put on the back burner. It's time to dust off those old contracts and give your monthly expenses some attention, as all trends indicate that as soon as the economy starts to recover, interest rates will see a steady increase.

Rates for 2021 are unprecedented. Typically, interest rates live in the high three, low four percent realm. Do you know how impactful an interest rate that is just one percent lower than your current one is? Payments that are just one hundred dollars less a month add up over time. Who couldn't use some extra cash, especially as we *hopefully* near the end of a pandemic?

It's true that refinancing costs money, just like securing your very first mortgage. Even with those costs factored in, many homeowners say that the money they were able to save by switching to a lower interest rate far outweighs any upfront costs they had to pay.

Now Is the Time to Act

If you've been contemplating a mortgage or a refinance, time is of the essence! Even if you refinanced last year, it may be worth refinancing again, depending on the terms you qualify for.

Rates are not expected to hold at these lows for long, which means if you delay the process, you've lost opportunities for savings before even getting started. The best way to learn about the interest rates that you qualify for is to connect with reputable lenders. Use Lendgo, a free, easy-to-navigate platform, to connect with such lenders now!

Get Free Quotes