Homebuyers, especially first-timers, can often feel some anxiety about their credit score. Many questions swirl around in their head. Is their score high enough to qualify for one of today's remarkably low interest rates? Will top-tier lenders approve their application, or will they have to deal with a bank they've never heard of?

Your credit reputation is based on various reports and scores. In conversation we often use shorthand to discuss "our credit report," but we really have three major reports, one from each credit bureau. The bureaus (also called credit reporting agencies) are independent companies with separate access to your financial records and their own methods of compiling reports. How you appear on paper at one bureau is not necessarily how you appear at the others.

"Credit bureaus often have business relationships with the same banks, credit card issuers, and even other businesses that you might have accounts with, but they're separate entities," writes financial blog The Balance. "Your account history will appear on one or all of your credit reports from these agencies because of their connections, but credit agencies don't share your account information with each other."

Different credit reports are not the only variety involved when a bank runs a credit check on you. You've probably heard of a FICO score. Well, you actually have several of those as well. One in particular is used widely across the mortgage industry: FICO Score 5.

You Have Many Different FICO Scores

Many people don't know they actually have several FICO scores. Here are the most common.

- FICO Score 2: Derived from information at Experian.

- FICO Score 4: Derived from information at TransUnion.

- FICO Score 5: Derived from information at Equifax. Especially popular for auto loans and mortgages.

- FICO Score 8: Popular for credit cards, FICO Score 8 is the first FICO score to combine information from all three bureaus. This score rewards people for making on-time payments and keeping low balances, while penalizing people for delinquency and opening too many accounts.

- FICO Score 9: Improving upon the three-reports-into-one-score model, FICO Score 9 touts greater predictability and brings three other key changes. Third-party collections that have been paid off no longer harm your score. Your rental history can improve your score. Medical collections are treated differently from other collections and won't harm your score as much.

- FICO Score 10 and 10 T: The latest FICO scores are the most predictive to date, says FICO. FICO Score 10 T could even become the new standard in mortgage lending. The T stands for trending; these scores look at trending data going back two years or more.

FICO Score 5 and FICO Score 8: How they're used.

Among consumers, FICO Score 8 is the most commonly used scoring model. When someone quickly checks their credit score on an app or website, what they see is Score 8. People with high FICO 8 scores qualify for low-interest credit cards. However, this score alone won't satisfy mortgage lenders. Big-money lenders want to know your FICO Score 5.

What's Special About Your FICO Score 5?

One reason moneylenders tend to rely on FICO 5 instead of FICO 8 is because the calculations in 5 are less forgiving of unpaid collection accounts, especially medical accounts. Your FICO Score 5 is what matters in the mortgage industry because lenders have tracked a statistically significant correlation between borrowers who lapse on repaying large, long-term collection accounts and those who default on their mortgage. Banks are all about assessing risk.

"Mortgages are very large loans, and mortgage lenders tend to be more cautious with them," explains financial blog Investopedia.

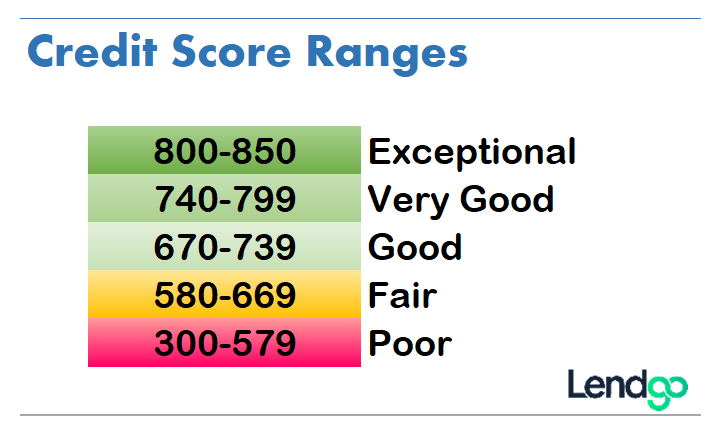

Credit scores directly affect mortgage interest rates. A difference of just 100 points could cost you—or save you—thousands of dollars.

Regardless of the FICO Score version, the keys to obtaining favorable FICO Scores remain the same according to the folks behind the scoring system, MyFICO.com:

- Make payments on time.

- Keep credit card balances low.

- Open new credit accounts only when needed.

Your Debt-to-Income Ratio Matters Too

Along with a good credit reputation, you need a low debt-to-income (DTI) ratio to qualify for the best interest rates. The DTI ratio is a handy number that reflects how much money you bring in each month versus how much flows out to repay debts.

To come up with your debt-to-income ratio, simply divide the total of all monthly debt payments (credit cards, student loans, car note, etc.) by your total monthly income (gross income, before taxes). The result is a percentage. Some DTI facts to know:

- Lenders use DTI, along with credit history, to evaluate whether a borrower is a low or high risk for a loan.

- Lenders all set their own DTI requirements.

- Personal loan providers generally allow higher DTIs than mortgage lenders.

According to NerdWallet, a debt-to-income ratio of 43% is generally the highest mortgage lenders will accept for a qualified mortgage. "Qualified" means the mortgage includes affordability checks.

"A debt-to-income ratio of 20% or less is considered low. The Federal Reserve considers a DTI of 40% or more a sign of financial stress," writes NerdWallet.

Related

Calculate your debt-to-income ratio in three easy steps.

"Experian Says I Can Boost My Score Easily With Its Service. Will It Help With a Mortgage?"

Experian has been garnering positive attention lately with its new Boost service. (It doesn't hurt that the credit bureau has been running ads all over the place.) As we explored in a previous article, Boost works by adding a person's streaming subscriptions and telecom/internet services to his or her overall credit score and is especially useful for young people who don't have many other accounts to base a score upon.

But will Boost help you with a mortgage? No, it won't. The service lifts your score at Experian, which in turn rolls into your FICO Score 8. But mortgage lenders, you now know, care more about your FICO Score 5.

FICO Score 5 vs. FICO Score 8

By now you know that one big difference between the two scoring schemes is that history from all three credit reporting agencies flows into your FICO Score 8, whereas your FICO Score 5 is based solely on data at Equifax. This makes your FICO Score 8 a more representative score because it draws from more sources than FICO Score 5.

Credit card companies and other consumer lending entities keep using FICO Score 8 despite there being later models (9 and 10) because Score 8 suits their needs. When you check your credit score in an app, you're likely seeing your FICO Score 8. It remains a very popular score for assessing one's overall creditworthiness as a consumer.

As for mortgage lenders—the big money—they continue to rely on FICO Score 5 because of its focus on unpaid collection accounts. There is a link between people who miss payments on big loans and those who default on their mortgage.

Related

The credit scores that matter in a partiucular situation

Finally, FICO Score 5, unlike 8, includes employment and residential history. Had lots of different jobs? Moved around a lot? If so, mortgage lenders might not think you're ready to buy a home.

What Do You Qualify For?

Connect with a top-quality lender to see what low rate you qualify for. We work with lenders who excel at meeting the needs of people whose credit scores aren't exactly perfect. By taking into account work ethic and other factors, these lenders can offer a lower rate to someone the other guys leave behind. Look at your options today.

Takeaways

- FICO Score 5 looks closely at how you've repaid credit cards and installment debts.

- Only Equifax data feeds into your FICO Score 5.

- Mortgage lenders focus on FICO Score 5 because statistically, how you managed monthly payments in the past predicts how you'll handle a home loan.