Why do popular finance experts like Clark Howard and Suze Orman urge people to switch to a 15-year fixed home loan? They understand how a shorter term and a lower interest rate combine to bring a double-whammy of savings much bigger than what most laypeople expect.

The dazzling drop in mortgage interest rates last year signaled a peak time for many homebuyers and homeowners to make the financial move they'd been waiting for. Every week, it seemed, rates melted like a snowball in the sun. We almost grew numb to seeing "historic lows" in the headlines and started seeing "How low can rates go?"

Get Free QuotesRefinancing their mortgage became irresistibly attractive to many homeowners, while buying a first home emerged as an exciting possibility for many renters. Assuming that one's financial health was steady despite the coronavirus pandemic, there had not been a better time in recent memory to make a big financial move.

Nobody knows how long this golden age of low mortgage interest rates will last, but everyone expects rates to rebound at some point in time—they won't stay this low forever. This month, in fact, rates are a tiny bit higher than last month. We may not know how long low rates will last, but we do know that every day we wait brings us one day closer to seeing the inevitable headline "Rates Rebound to Pre-Pandemic Highs."

"If you wait until the latter half of 2021, some experts say that will be too late to grab the best rates," writes John Csiszar for GoBankingRates. "If predictions of an economic recovery on the back of widespread vaccine distribution hold true, rates could rise before the end of the year."

Speaking of waiting: What if you only had to wait 15 years to own your home outright? Not 23 or 20 or even 18 years—just 15. The 15-year fixed-rate mortgage is more affordable now than ever, with a financial upside that's hard to beat.

So, why do Clark Howard, Suze Orman, and so many other money gurus urge people to switch to a 15-year fixed mortgage? Here are two of the most compelling reasons.

Get Out From Under an ARM

The first compelling reason to switch to a 15-year fixed-rate mortgage today is that some homeowners currently have adjustable-rate mortgages (ARMs), so a move to a fixed-rate loan won't only save them money at today's low rates but also give them a steadier financial footing and more predictability.

In fact, one of the best reasons to refinance is to get away from an unpredictable ARM. With an ARM, it's scary to know that your monthly payments could go up. The uncertainty makes financial planning more difficult. As 2020 taught us, life is unpredictable enough without having a question mark looming over your mortgage payment because of the changing nature of an ARM.

“Let's run through the advantages of a shorter-term loan. For starters, the interest rate is lower. … Because of the lower interest rate and the shorter payback period, you owe a lot less interest on a 15-year, over the life of the loan.”

Slash Years and Interest off Your Current Loan While Making the Same Payment

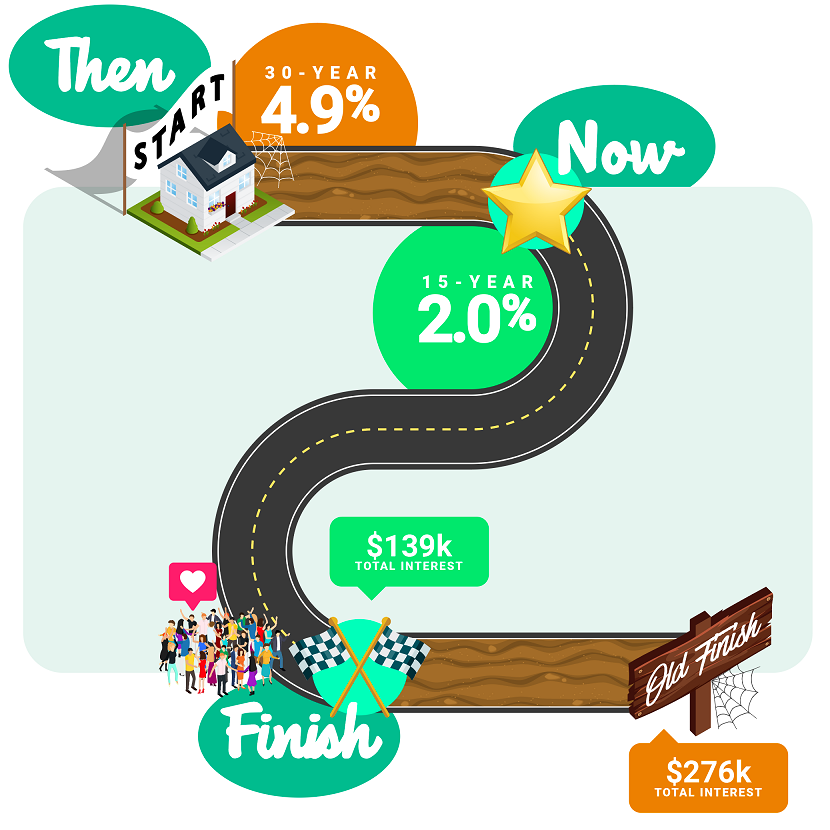

The second and most universal reason why someone should switch to a 15-year fixed-rate mortgage right now is because homeowners who secured their 30-year loan seven or eight years ago could use today's low rates to reset the clock to 15 years while keeping their payment the same. Running your own numbers could be very enlightening. We'll break down a typical example to illustrate the surprising affordability of today's 15-year fixed-rate loans and their big financial upside.

Let's say you borrowed $300,000 to buy a home in 2014, when annual percentage rates were typically 4.9%. Your payment has been $1,601. You are now seven years into the term. So far you have paid $98,076 in cumulative interest, and the loan balance is down to $263,566. (We got all these figures using the free Loan Amortization Schedule template included in Microsoft Excel.) When the day comes that you make your last payment and own the home in full, you will have paid $276,472 in total interest.

|

Scenario 1. Original mortgage, 2014 |

|

|---|---|

| Loan amount | $300,000 |

| Rate | 4.9% |

| Payment | $1,601 |

| Loan period in years | 30 |

| Balance after 7 yrs | $263,566 |

| Interest paid after 7 yrs | $98,076 |

| Total interest over 30 yrs | $276,472 |

One figure in that table might surprise you, the total interest over 30 years. It really does cost $276K to borrow $300K at 4.9%—shocking! It's almost like you're paying for the home twice. We depend on appreciation to make sense out of this kind of deal. Hopefully the home is worth a lot more—even twice more—after 30 years.

“If you have 23 years left on your mortgage, don’t go into a new 30-year loan. If you can’t afford the payment of a new 15-year loan, it’d be much better if you go into a 20-year loan. Or do anything other than lengthening the term of your loan because you’re going backward.”

—Clark Howard, as quoted on Clark.com

Now let's use this situation to see what's possible if you get one of today's much lower rates and you keep making roughly the same payment you're comfortable making.

You could shorten the loan term quite a lot so long as you don't mind increasing the payment a little. (You probably won't feel any increase because after five or six years of homeownership you stopped having to pay PMI, and that saves you a few hundred dollars every month that can now be redirected to your mortgage payment.) Instead of lowering your payment by keeping the loan term 23 years (or worse, by resetting the clock back to 30 years), you would hold the payment steady and see how many years you could slash from your debt.

Let's say you pay off the old mortgage by taking out a new one for $263,000 at 2.0% fixed. Making close to the same payment ($1,692) as you made before, you can own the home in just 15 years, not 23. That puts you eight years closer to living mortgage-free. Come the day you make the last payment, you will have paid $41,637 in total interest on this loan plus the $98,076 you paid on the previous loan, adding up to $139,713, as you see below. That's half the cumulative interest of the original mortgage. Big savings!

|

Scenario 2. Refi but keep payment about same |

|

|---|---|

| Loan amount | $263,000 |

| Rate | 2.0% |

| Payment | $1,692 |

| Loan period in years | 15 |

| Interest over 15 yrs | $41,637 |

| + Interest paid on original loan | $98,076 |

| Total interest paid, both loans | $139,713 |

Comparing the last rows of Tables 1 and 2, cumulative interest has been slashed in half. It's a definite win-win when you can cut eight years off your mortgage term and save $137K in total interest, all while keeping your payment about the same.

Takeaways

- A 15-year refinance is more affordable now for more homeowners.

- Cutting years off your loan term brings stupendous savings.

- Combine a shorter term with one of today's low refi rates, and you get a double-whammy of savings.

Related Posts